Feb 26, 2016

This is one of my favorite episodes we've ever done - my

conversation with Digit founder and CEO, Ethan Bloch.

Digit has set out to solve one of the core problems in

consumers' financial lives - how to save. Their solution is to make

savings effortless, using an intelligent algorithm that analyzes

your spending and income patterns and automatically moves funds

into savings. I had dinner with Ethan last summer and suddenly

realized he was describing an "Uberization" of savings, paralleling

the financial industry's efforts to "uberize" payments, in the

sense of making the mechanics disappear, like the non-exchange of

money at the end of an Uber ride. Out of sight, out of mind.

With Digit, you sign up, and you automatically start to

save.

I had always assumed that getting people to save requires

fostering mindfulness - getting people to think long term instead

of short term. Digit is going in the opposite direction - not

mindfulness, but mindlessness. Again, effortlessness. Instead of

hoping people will form habits that keep them focused all the time,

on saving Digit just lets them decide to save one time. After that,

they save. He's trying to drive the "minutes per year" spent on

saving to nearly zero. No more budgets, expense tracking, figuring

how much you should save and can save and did save. They're

breaking all those practical barriers that keep most people

stuck.

I know it bothers some people to have consumers saving

without thinking. We wish, instead, that everyone would become

financially educated and focus on their life goals - you could call

it developing the financial virtues. There are innovators working

on that approach, too, using behavioral economics to get people

motivated. Still, if the eat-your-spinach approach was going to

work, it probably would have by now. It's time to try new tools. I

know other companies working from the same logic.

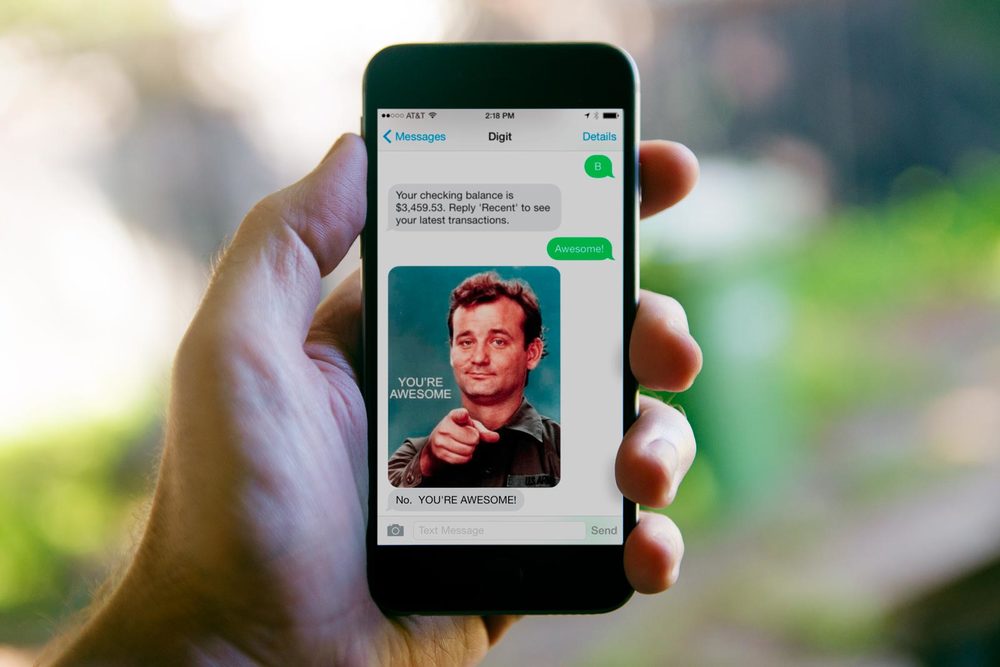

And here's an interesting twist. After Digit gets people

started on effortless saving, they actually do switch over to

mindfulness. They start texting their customers about daily savings

progress. And they do it with humor which, as I've been saying, is

a secret weapons of many fintech innovators. They are blowing up

the boredom factor that keeps so many people from focusing on their

finances. I asked Ethan for examples of this. Unfortunately I

didn't get the jokes because they're aimed at millennials, but if

you -- unlike me -- happen to know what's cooler than cool, Digit

will send you this fun

GIF.

Speaking of millennials, Digit's average user is 27 years

old. Some people want to dismiss fintech solutions for this group,

because so many other consumers need tools too My answer to that

is, the millennials are the early adopters of new technology. It

makes sense to start with them. As these products get traction,

they will broaden. Listen to Ethan, and many of our other

guests, and you hear a big vision about remaking the financial

lives of everyone. (And by the way, we do have a show coming up

with Bee, which is reaching for a very different

market.)

At the age of 30, Ethan is at the forefront of the fintech

revolution. Digit is a winner of the Financial Solutions Lab

competition sponsored by CFSI and JPMorgan Chase, which focused its

first year on solutions for the more than one-third of Americans

who struggle with managing cash flow management. (Recall that

another winner was

Ascend - we talked with its founder, Steve

Carlson, in

Episode 9).

Ethan explains how much money Digit has saved people so far

(by the way, we recorded this discussion late last year, so his

progress data are for 2015, not 2016). He explains how customers

are using the savings they build up. He describes their investors

and business model and plans.

And he talks about how to design great financial tools, that

are like smart phones - that people can just pick up and use,

without needing manuals, much less lengthy federal disclosure

documents.

Speaking of those, Ethan really calls out the failures of

disclosures. He also discusses the shift underway toward a more

principles-based approach (echoing our episodes with other guests,

including

Thomas Curry). He describes, too, the huge

obstacles to innovation that arise from well-intentioned government

efforts, including the difficulties innovators face in working with

banks.

Ethan also had the most surprising answer I've gotten yet to

my standard question on how he keeps up with technology

change.

Finally, for our many listeners who play Barefoot Innovation

while you're carpooling to school in hopes it will inspire your

kids to grow up and found the next PayPal, I should say I'm rating

this episode PG-13, for language. Ethan uses a few words in our

conversation that...let's put this way, you hardly ever hear them

on National Public Radio.

Learn more at www.digit.co and @hellodigit and

@ebloch and find further

links below:

- On banks opening up their APIs

- The book "Rainbow's End"

- CFSI's research on the U.S. Financial Diaries

Note to Our Listeners:

If you're enjoying Barefoot Innovation, please be sure write

a review on ITunes and also click the Donate button, to help us can

keep it growing!

Last but not least, I am finally launching my

long-in-the-making video series, Regulation Innovation. It's for

people in the financial world contending with the top two

disruptive challenges - regulation and technology innovation. It

for both business and regulatory people, and for both traditional

companies and innovators. I'll have much more information coming on

this, but please come to www.jsbarefoot.com in

March, and check it out! I promise, there is nothing else

remotely like it.

If you enjoy our work to bring together thought provoking ideas and people please consider a contribution to support the site.

Support the PodcastPlease subscribe to the podcast by opening your favorite podcast app and searching for "Jo Ann Barefoot", in TuneIn, or in iTunes.