Dec 10, 2017

I’ve been looking forward to today’s show since my very first visit to the UK’s Financial Conduct Authority, over two years ago. It was clear even then that they were doing something completely new for a regulatory agency. They were innovating. Not just creating new regulations, but actually rethinking how to create them. Reinventing the regulatory process itself.

Specifically, they were responding to the novelty and especially the rapid pace of technology change in finance by creating an innovation initiative and soon thereafter, the world’s most famous regulatory sandbox.

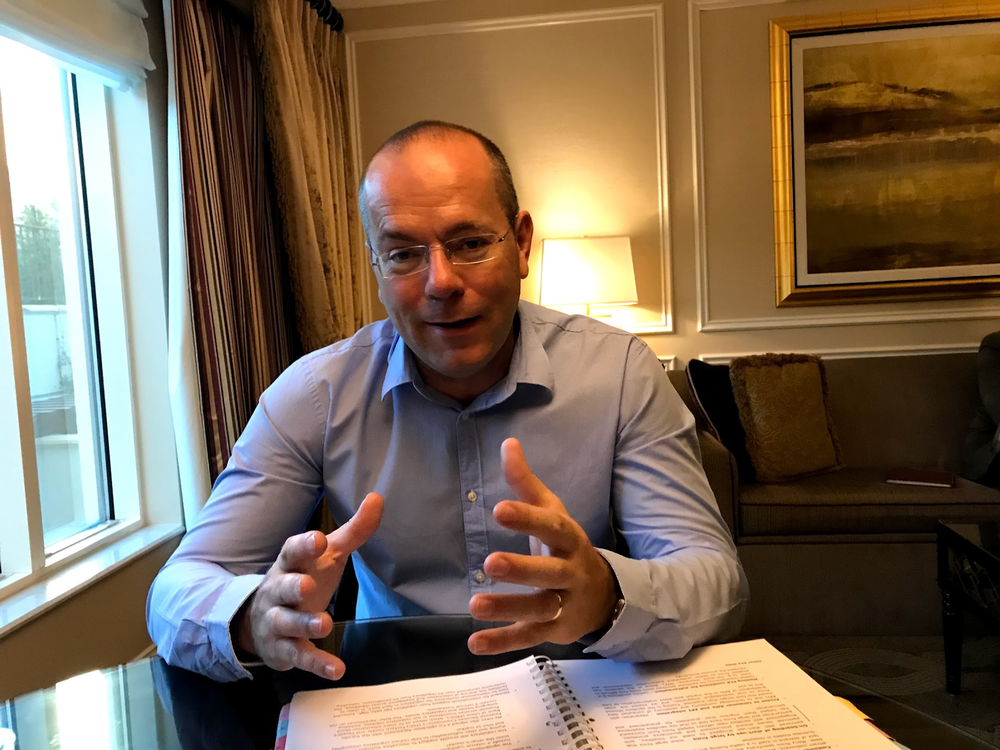

Today’s guest is Christopher Woolard, the FCA’s head of Strategy and Competition. In this episode, he tells the story of how they first realized they had to change, how they did it, and, importantly, what they’ve been learning so far. We sat down together last month during the Money 20/20 conference in Las Vegas, where we also did a fireside chat on the regulatory stage and where, for the first time, Chris shared their new report on lessons drawn from their first several cohorts of sandbox companies.

Most of our listeners know what these sandboxes are -- they’re also sometimes called reglabs, greenhouses, or a new generation of pilot projects. They’re being adopted by a leading cadre of regulators, including a few in the United States, who have realized that the speed of innovation today is outstripping traditional regulatory processes, which means policymakers are going to have to invent something new to keep up. Part of what they’re inventing are these small, safe “testbeds” where they can get hands-on with new ideas, understand them, shape them if appropriate, and generate insights to feed back into mainstream regulatory activities. The original version, really, was in the United States in the CFPB’s Project Catalyst, which inspired the FCA to build something similar. But it was the UK’s much bigger and bolder effort that then caught the world’s attention and has now inspired several dozen imitators around the world, according to Aspen Institute research. Here is an article I wrote with more on how the program is designed.

The FCA itself grew out of the financial crisis, as the UK decided to separate prudential banking oversight from a new entity focused on “conduct.” In some ways the restructure mirrors the U.S. decision to create the CFPB after the crisis, except that the FCA’s remit is not limited to consumer protection. The UK Prudential Regulation Authority is now housed in the Bank of England in the old City, while the FCA inhabits contemporary offices out in Canary Wharf, in an area burgeoning with startups and financial companies converting old warehouses to cool new space.

In our talk, Chris describes what the FCA is doing in both the sandbox and the agency’s wider set of innovation initiatives -- and again, what they’re learning so far. He cites the FCA’s advantage over many regulators in having a mandate that includes fostering competition. He debunks some misconceptions about the UK sandbox, including that it waives or dilutes consumer protections. He touches on their work in regtech (a topic we’ll soon return to with the FCA’s regtech head, Nick Cook, in an upcoming show). He talks about the sandbox’s global imitators and also how the UK cooperates directly with other countries to ease the path for their respective innovators. And he shares his concern that if even one of these global sandbox experiments “catches a cold,” we could see a contagious loss of confidence that could undermine regulatory innovation, worldwide.

I admire the FCA’s deft mixing of a very high-profile, exciting initiative with, simultaneously, a strong note of humility. They always emphasize that they don’t have all the answers, that they’re just learning as they go. But this, you see, is actually the key. The thing they figured out -- and believe me, it doesn’t come easily to regulators (or to anyone, for that matter) -- is that it’s not going to be possible, anymore, to figure things out before acting, in the way policymakers used to do. Instead, regulatory institutions are going to have to learn to navigate permanent and daunting, technology-driven uncertainty. They won’t have the option to hold still and wait for clarity to materialize...because it won’t. They need to find ways to move ahead iteratively and collaboratively. Testing -- sandboxes and reglabs -- will be essential to that. It’s a huge change, in both process and culture, for both regulators and industry. The sooner everyone starts making this shift, the better.

The FCA’s humble tone is right and wise, but my view is that this regulator has shown not only vision, but also courage. They decided to take the risk to strike out in uncharted territory, to begin to blaze a new kind of policy pathway, and they’re inspiring many others to follow them.

More on Christopher Woolard:

Christopher Woolard is Executive Director of Strategy and

Competition, and an Executive Board Member of the Financial Conduct

Authority. He’s responsible for policy, strategy, competition,

market intelligence, consumer issues, the Chief Economist's

department, communications and the Innovate initiative. He is chair

of the FCA's Policy Steering Committee and a non-executive board

member of the Payment Systems Regulator.

Christopher joined the FCA in January 2013. Previously he was Group

Director and Content Board member at Ofcom. He has spent most of

his career in regulation or policy development including working at

the BBC and in government as a senior civil servant. He is a Sloan

Fellow of London Business School.

Here are resources and links to items mentioned in the episode:

- Financial Conduct Authority Website

- FCA Project Innovate

- FCA Innovation Hub

- FCA Regulatory Sandbox

- FCA Report on Sandbox Results

- My podcast with Wai-Lum Kwok on Abu Dhabi’s Reglab

More for our listeners

I’m in the midst of a busy set of travels that will produce some fascinating podcasts. Between November 1 and December 20, I’m traveling to seven countries -- three in Asia, three in Europe, and one in Africa -- to speak on fintech and regtech for both industry and regulators. As I mentioned, we’ll have a podcast with the Nick Cook, who leads the FCA’s innovation work on regtech, recorded at Regtech Enable in Washington. We have one coming up with Wells Fargo’s Braden More on payments innovation. We’ll have Nerd Wallet CEO Tim Chen, and Cross River Bank CEO Gilles Gade. We’ll have one in London with the charismatic CEO of Starling Bank, Anne Boden and with the trade association Innovate Finance, and also a lively discussion with a group of amazing innovators working in Europe and Africa. We’ll have one with Michael Wiegand, who heads the Gates Foundation’s work on financial services for the poor. And back in the U.S., we’ll have a show with Financial Services Roundtable CEO Tim Pawlenty...to name a few!

Plus, I’ll be recording a special series straight from the floor of the American Bankers Association conference on financial crimes, in December.

I hope to see many of you there and at other upcoming events, including these:

- S&P’s Fintech Intel, December 13, New York

- The African Fintech Forum, December 18-19 in Abidjan, Ivory Coast www.africafintechforum.net

- Dutch Central Bank, December 20, Amsterdam

Please remember to review Barefoot Innovation on iTunes, and sign up to get emails that bring you the newest podcast, newsletter, and blog posts, at jsbarefoot.com. Be sure to follow me on twitter and facebook. And please send in your “buck a show” to keep Barefoot Innovation going. See you soon!

Support our Podcast