Mar 22, 2016

In 1967, the Beatles sang: "I get by with a little help

from my friends." That sentiment captures something at the heart of

many people's financial lives today, and it embodies the idea

behind the National

Foundation for Credit Counseling (NFCC), the

oldest and largest nonprofit credit counseling organization in the

U.S.

I have known Susan Keating, NFCC's President and CEO, for

about 30 years. I've been wanting to record a Barefoot Innovation

episode with her, because the NFCC is on the front lines of the

topics we're exploring here. They work directly, personally, with

the people who are not thriving in our consumer financial system.

The reasons people don't thrive are complex. We've talked about a

lot of them, and I find it's easy to get excited about new

technologies or regulatory challenges impacting them, and to lose

sight of the real people who are immersed in these struggles.

Helping these people is the driver behind much of the search for

better solutions by industry, government, and the innovation world,

and it's good to pause and think about who they are.

As we discussed with CFSI's CEO Jennifer Tescher LINK TO IT,

the so-called "underserved" market is enormous -- estimated between

70 and 140 million Americans -- and covers a huge percentage of the

middle class. It is also heterogeneous. Data from NFCC, CFSI and

others is breaking the old stereotype of a monolithic "low and

moderate income" category whose problem is just not being able to

afford traditional financial services. Many underserved

consumers, in fact, can afford to pay for high-cost financial

services, and are doing so, but are stuck there due to a wide array

of issues. Some of their problems are caused by their own errors

and difficulties. Some are caused by the difficulties of serving

them through the business models and cost structures that prevail

in the industry today. Some are a mix of both.

Both of these kinds of problems are ripe for improvement

today, thanks to the innovations we discuss here on this show. I

think, though, that we'll still have a big gap between new

financial solutions and the people who need them, unless we build

some bridges -- add in some glue -- in the form of human beings who

can help people learn to use new technology. NFCC is one of the key

organizations able to do this.

Susan talks about all this in our conversation. She describes

the massive scope of the challenge; the "new face of poverty" in

the United States; the NFCC's focus on "breadwinner moms;" and its

key new initiative for helping people manage student debt, with a

insight into the daunting scope of that challenge.

Susan's background:

Susan began her banking career in 1974 at First Bank System

in Milwaukee, where she became Senior Vice President of retail

banking. In 1988 she joined MNC Financial in Maryland and later

became President and senior banking executive for Maryland when

NationsBank (Bank of America) acquired MNC in 1993.

She went on to become the highest-ranking female CEO of a

US-bank holding company, as President and Chief Executive of All

First Financial from 2000-2002. Then in 2002, she was appointed to

the Group Executive Committee of AIB (Allied Irish Banks plc),

which is responsible for developing corporate strategy and

overseeing management of AIB Group.

In 2004 she took on the role of NFCC President. She thought

is was a short term move but, to her own surprise, she's still

there twelve years later, caught up in

the mission. Upon reappointment after her first three-year term,

she said, "The NFCC is uniquely positioned to serve the many

consumers who are struggling to make ends meet and find their way

to a better financial future. I am deeply committed to doing all

that I can in order to lead the efforts in the years

ahead."

Susan also serves on Bank of America's National Consumer

Advisory Council; is a board member of the Council on

Accreditation; and participates in the Financial Regulation Reform

Collaborative, a non-partisan group committed to finding solutions

for reforming financial services regulation.

NFCC:

Last fall I had the honor of joining the NFCC's board on the

occasion of the organization's 50th birthday. Today the NFCC works

with 90 member agencies through more than 750 offices in

communities nationwide. Its certified counselors counsel and

provide financial education to three million clients annually,

focusing on issues that include seniors and the military and

guidance relating to financial literacy, mortgages, and credit

cards. It recently launched a key initiative on helping people with

student debt, and in helping illuminate that magnitude of that

challenge, and plays an invaluable role in consumer financial

research overall.

Here are some links:

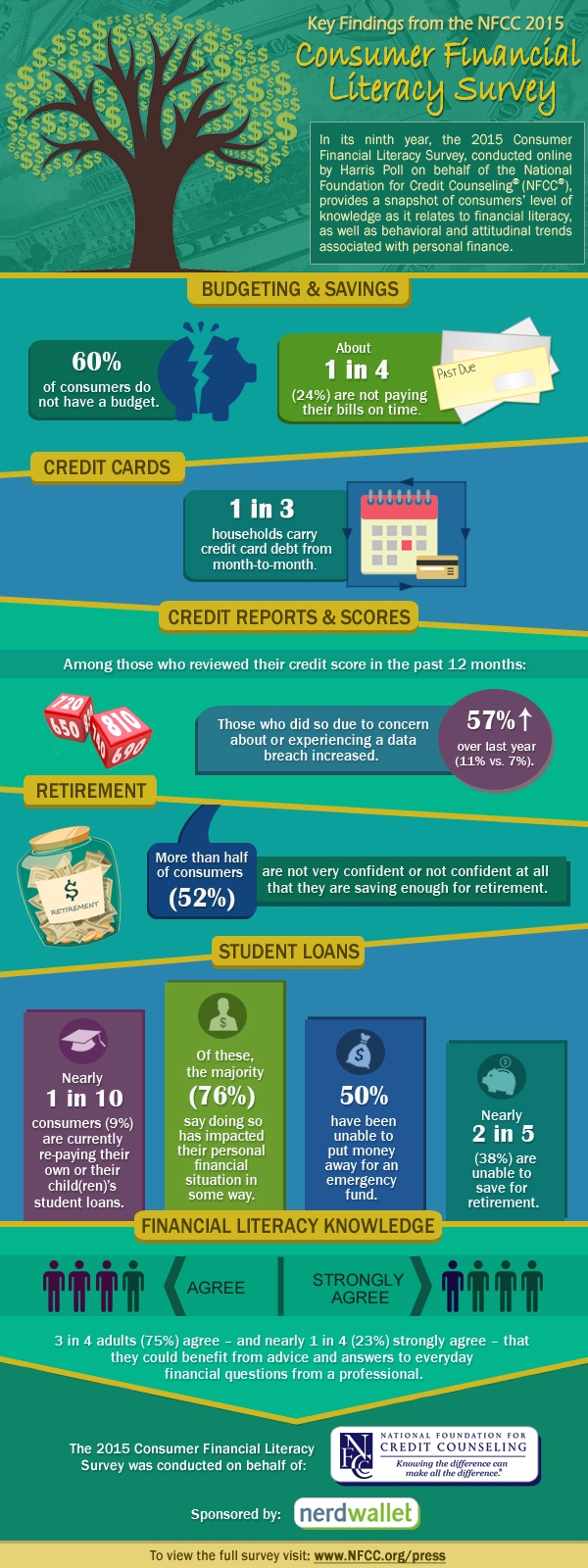

- 2015 Consumer Financial Literacy Survey

- 2015 State of the Financial Counseling and Education Sector

- Student Credit Counseling initiative

Enjoy my conversation with someone on the front lines --

NFCC's CEO Susan Keating.

And please note:

The video series is launched! Please come to my new

site www.RegulationInnovation.com

where we have launched my video briefing show. It's a

practical guide for financial companies trying to figure out how to

thrive on disruption-to thrive through the twin, intertwined

challenges of technology disruption and regulatory disruption.

We're off to a terrific start with the series.

The next video will be called, "The 5 Tech Trends." I made it

because I think financial people often underestimate the disruption

underway, because we tend to think of fintech as a financial topic.

In reality, it's mainly a technology topic. That means the forces

shaping it lie mainly in the tech world, not the financial world.

That in turn means they are mostly over the horizon, outside the

field of vision of busy people focusing on finance.

I've been spending a lot of time in that world, and am

creating this video to explain what these five huge drivers are,

how they are converging, and how they will transform both consumer

financial services and financial regulation. Again, fintech is way

more about "tech" than "fin."

I'll also have a light-hearted short video for your

entertainment, brought to you from my very own kitchen. I'm going

to demonstrate an extremely odd little gadget that contains a big

lesson for innovators.

Coming episodes:

Last but not least, come back next time to Barefoot

Innovation, when my guest will be the visionary CEO of Opportun,

Raul Vazquez. Among other things, he is totally fascinating on the

topic of how he personally keeps up with technology.

Up next in the queue after Raul, we'll have a short update

with Simple CEO Josh Reich, and then an interview with the founder

and CEO of Betterment, Jon Stein.

See you soon!

As always, please donate to my free podcast series (which seems to be trying to take over my life) and please write a review of it on ITunes!

Support the Podcast